A Comprehensive Guide to Series A, B, and C Funding Rounds for Startups

Launching a startup with an innovative business idea is just the beginning of a long and challenging journey. After getting the initial operations off the ground, a company typically relies on its founders’ savings, contributions from friends and family, and any early revenues. Over time, as the startup demonstrates the value of its products or services, its customer base grows, paving the way for expansion. With dreams of scaling operations, hiring employees, opening new offices, and even considering an Initial Public Offering (IPO), the company begins to eye the next critical step: external funding.

The Reality of Startup Growth and Funding

While some rare businesses achieve exponential growth without external help, the vast majority of successful startups rely on external funding to fuel their growth. This external funding often comes in rounds: Series A, Series B, and Series C—each representing a significant stage in a startup’s development. These funding rounds provide opportunities for investors to exchange capital for equity, gaining partial ownership of the company.

Early on, startups may pursue seed funding or angel investments to validate their business model and cover operational costs. However, as businesses evolve, they often require additional funding to scale operations and compete in the market. Relying solely on personal resources or informal contributions from friends and family—commonly referred to as “bootstrapping”—is rarely sustainable. This is where structured funding rounds become essential.

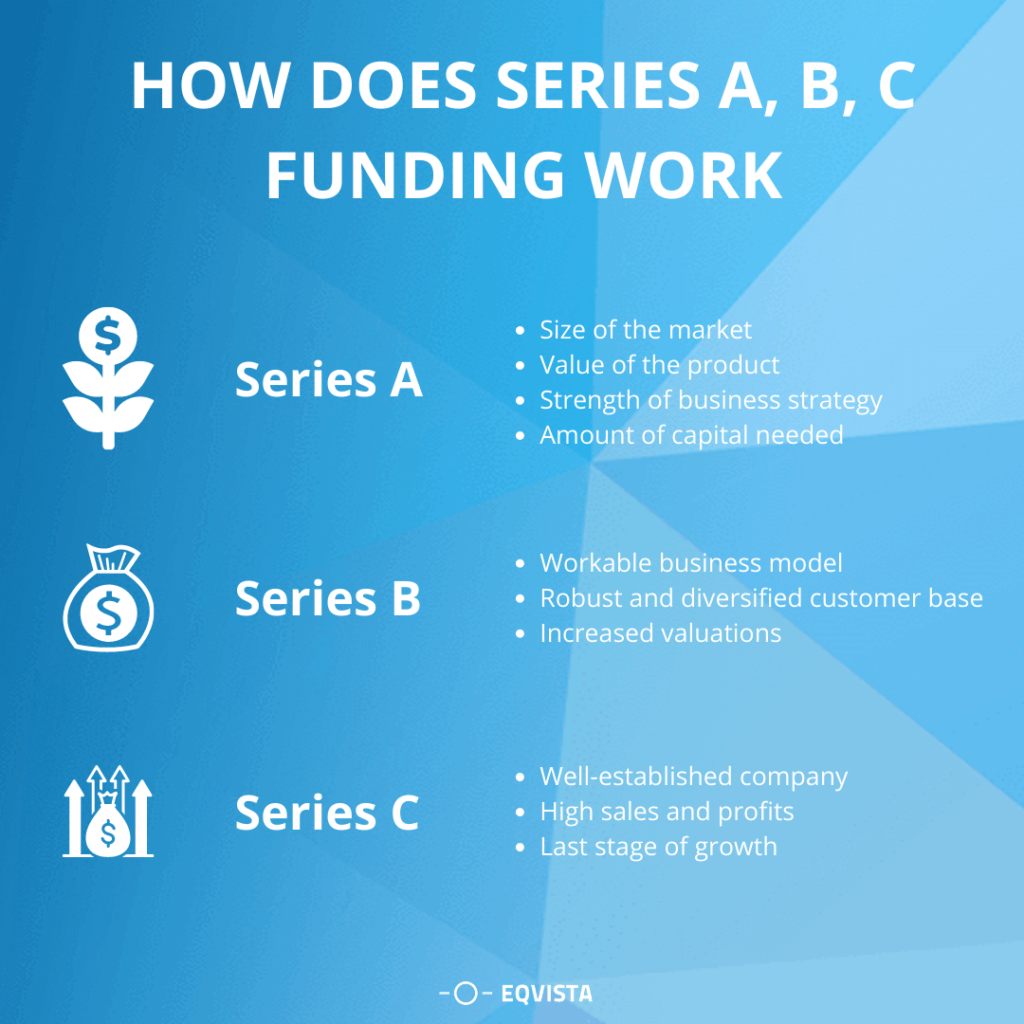

Breaking Down Series A, B, and C Funding Rounds

Understanding these funding stages can help you grasp the dynamics of startup growth and analyze trends in the business and investment world. Here’s a closer look at what distinguishes Series A, B, and C funding rounds:

Series A Funding: Laying the Foundation for Growth

The Series A round is typically the first major funding event after seed funding. By this stage, startups have established a viable product or service and demonstrated some market traction. Series A investors are focused on helping companies refine their business models, expand their market reach, and scale operations. Key features of Series A funding include:

- Goal: Build a solid operational foundation and enhance customer acquisition efforts.

- Investors: Often led by venture capital firms experienced in early-stage funding.

- Capital Use: Hiring key team members, refining the product, and increasing marketing efforts.

Series B Funding: Scaling the Business

Once a startup has a proven track record and a growing customer base, it enters the Series B round to scale further. This funding supports expansion efforts, such as increasing production capacity or entering new markets. Key highlights of Series B funding include:

- Goal: Scale the company to meet growing demand and achieve dominance in its niche.

- Investors: Venture capital firms, often those involved in Series A, alongside new participants.

- Capital Use: Expanding teams, optimizing operational processes, and exploring strategic partnerships.

Series C Funding: Preparing for Dominance or IPO

Series C funding is for startups that are already successful and looking to achieve significant milestones, such as acquiring competitors, launching into new markets, or preparing for an IPO. Series C investors are typically more risk-averse and focused on supporting well-established businesses. Key points include:

- Goal: Solidify market leadership and pursue major growth opportunities.

- Investors: A mix of late-stage venture capital firms, private equity firms, and institutional investors.

- Capital Use: Strategic acquisitions, large-scale expansions, and IPO preparation.

The Journey Beyond Series C

Some startups may continue to seek additional funding rounds, such as Series D or E, depending on their goals and market conditions. However, many successful businesses use Series C as a stepping stone to go public or execute significant mergers and acquisitions.

Why Understanding Funding Rounds Matters

Each funding round reflects a company’s growth stage, challenges, and opportunities. By understanding the distinctions between Series A, B, and C funding, you gain insights into the startup ecosystem and the strategies businesses use to scale and succeed. These funding stages are not just financial milestones—they are pivotal moments in transforming a brilliant idea into a global powerhouse poised for an IPO.

Wrapping Up

Whether you’re an aspiring entrepreneur, an investor, or simply curious about how businesses grow, understanding funding rounds is crucial. Series A, B, and C are not just terms; they represent the lifeblood of startup success, guiding companies from inception to industry dominance.

An In-Depth Guide to Series A, B, and C Funding: Fueling Startup Growth

In the startup world, securing funding is a critical part of turning an idea into a thriving business. Each stage of funding—Series A, B, and C—represents a unique phase of growth and opportunity. These funding rounds not only provide the financial resources needed for expansion but also attract strategic partners who can drive innovation and success.

Below, we dive deeper into the intricacies of each funding round, exploring their goals, challenges, and the value they bring to a growing business.

Series A Funding: Building the Foundation for Success

Purpose:

Series A funding is the first substantial round of investment that startups pursue after seed funding or angel investments. At this stage, the business has typically developed a minimum viable product (MVP) and demonstrated market potential. The focus shifts from proving the concept to scaling the business model.

Key Characteristics:

- Amount Raised: Typically ranges from $2 million to $15 million, depending on the industry and market.

- Valuation: Businesses often have valuations between $10 million and $30 million at this stage.

- Investor Focus: Investors look for evidence of product-market fit, early traction, and a scalable business model.

What Investors Expect:

Series A investors, often venture capital (VC) firms, are interested in startups with strong potential for high growth. They scrutinize metrics such as user acquisition rates, customer retention, revenue generation, and market opportunity. Startups must demonstrate that they have a solid strategy to use the funding effectively.

How Funds Are Used:

The capital raised in Series A is often allocated to:

- Expanding the product development team to refine and innovate offerings.

- Scaling marketing and sales efforts to capture more customers.

- Strengthening infrastructure to support growing operations.

Challenges:

Securing Series A funding is often referred to as the first major “valley of death” for startups. Many businesses fail to secure this round due to insufficient traction or an unclear vision for future growth.

Series B Funding: Scaling Up

Purpose:

Series B funding supports startups that have successfully navigated the challenges of early growth and are ready to scale their operations significantly. By this stage, businesses have a proven product and a steady revenue stream, but they need more capital to expand.

Key Characteristics:

- Amount Raised: Typically between $10 million and $50 million.

- Valuation: Startups are often valued between $30 million and $60 million.

- Investor Focus: Investors look for evidence of consistent revenue growth and market validation.

What Investors Expect:

Investors in Series B funding rounds are keen on startups with a clear path to scalability. They evaluate the company’s ability to expand its market share, enter new regions, and build a competitive edge. Metrics like monthly recurring revenue (MRR), churn rate, and customer acquisition cost (CAC) become critical.

How Funds Are Used:

The capital raised in Series B is typically deployed to:

- Scale the workforce, including hiring specialized talent in sales, marketing, and engineering.

- Enhance operational systems and technology to handle increased demand.

- Broaden market presence through aggressive expansion strategies.

Challenges:

At this stage, startups must balance rapid growth with operational efficiency. Mismanaging resources or expanding too quickly can jeopardize the business.

Series C Funding: Dominating the Market

Purpose:

Series C funding is designed for companies that are well-established and aiming for market dominance. These businesses are often preparing for major milestones such as international expansion, acquisitions, or an Initial Public Offering (IPO).

Key Characteristics:

- Amount Raised: Can range from $50 million to $100 million or more.

- Valuation: Businesses are commonly valued at $100 million or higher.

- Investor Focus: Late-stage investors, including private equity firms and hedge funds, join in.

What Investors Expect:

Investors in Series C are typically more risk-averse, as they focus on companies with proven profitability and market leadership. The emphasis is on scaling globally, acquiring competitors, or diversifying product lines.

How Funds Are Used:

Series C funding is utilized for:

- Expanding into international markets.

- Strategic acquisitions to consolidate market share or enter new industries.

- IPO preparation, including hiring legal and financial advisors.

Challenges:

At this stage, startups face intense competition and scrutiny. Maintaining innovation and operational excellence while pursuing aggressive growth is a delicate balance.

Beyond Series C: Additional Rounds and IPOs

For some startups, Series C is not the end of the funding journey. Depending on their goals, they may pursue Series D, E, or beyond. These rounds are often aimed at addressing specific needs, such as stabilizing operations, responding to market changes, or preparing for an IPO.

Initial Public Offering (IPO):

An IPO marks a company’s transition from private to public ownership. This milestone allows businesses to raise significant capital from public markets while providing liquidity to early investors and employees.

Key Takeaways: Choosing the Right Funding Path

Understanding the nuances of Series A, B, and C funding rounds is essential for entrepreneurs and investors alike. Here are some final considerations:

- Tailor Your Approach: Each funding stage requires a tailored strategy, from pitching to investors to allocating funds effectively.

- Build Relationships Early: Strong relationships with investors can pave the way for smoother funding rounds.

- Track Key Metrics: Consistently monitoring growth metrics ensures you can demonstrate value to potential investors.

By navigating these funding rounds strategically, startups can turn innovative ideas into market-leading enterprises, achieving success in competitive industries. Whether you’re an entrepreneur seeking capital or an investor eyeing the next big opportunity, understanding Series A, B, and C funding provides valuable insight into the path to success, reach out to Cash Credit for tailored Seed funding strategy.